Contents

- Global Gaming Market Size Report

- Number of Players & Platform Percentage Breakdown by Region Within Asia

- Analysis of Top Game Genres & Age Groups by Region Within Asia

- Game Communities & Viewing Platforms for Games & Main Advertising Sites

- Why Gamers Make a Purchase & Marketing Pricing

- Our Game Media: AUTOMATON

- Our Game Promotion Service Results

- Our Multilingual Community Management Service

- Feel free to contact us with any questions about marketing in Asia or any other questions you may have!

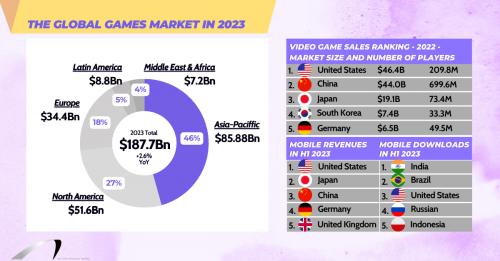

Global Gaming Market Size Report

First, let’s take a look at the latest 2023 Global Gaming Market report. Asia accounts for 46% (85.8 billion) of global gaming revenue, which is nearly half of the market. This is followed by North America 27% ($51.6 billion), Europe 18% ($34.4 billion), Latin America 27% ($8.8 billion), and the Middle East & Africa 4% ($7.2 billion). When looking at the 2022 Video Game Sales Rankings by country, with the exception of the US, the top four positions are dominated by Asian countries, clearly showing that Asia has become essential for the growth of video game sales on the global market.

In the mobile gaming market, India with an overwhelming number of mobile players, dominates the mobile download rankings for 2023, far ahead of Brazil in the number two slot. However, when comparing downloads to revenue, it is clear that a higher number of downloads does not correlate to increased revenue. Out of the top 5 countries in mobile downloads, only the US appears in the top 5 countries for mobile revenue. The majority of the games downloaded in those countries, with the exception of the US, were free-to-play with the main source of revenue coming from in-game advertisements rather than from the players themselves. Additionally, just because a game sells well in one country, such as China, does not guarantee that it will do well in other countries, like Japan. Because of the potential to have a very large fan base for a single title, the amount of revenue gained from a single game can be extremely high. A hit game can lead to a large profit, but not all games are successful in all markets. Therefore, marketing is extremely important for mobile games. In addition to promotion, community management is also key to increasing customer satisfaction and encouraging player turnover.

Source:https://newzoo.com/resources/rankings/top-10-countries-by-game-revenues

Source:https://apptica.com/

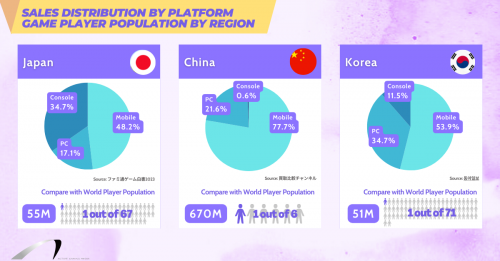

Number of Players & Platform Percentage Breakdown by Region Within Asia

Next, let’s look at the game player population and the platforms used in each country. It should come as no surprise that China has a large number of gamers, with about one in six of the world’s gamers being Chinese players. Japan and Korea are very similar in size with only about a 4 million difference in favor of Japan. However, when it comes to the ratio of the platforms used, as the chart above shows, there are some very stark differences. The following is an overview of the history and cultural characteristics that are believed to influence the ratio.

🔶Japan:Influence of Console Culture

Japan has a long and deep history of console gaming with companies such as Nintendo and Sony leading the global gaming industry. As a result, the majority of Japanese gamers prefer playing on a console. However, while the number of PC gamers in Japan has historically been low, there has been significant growth recently, doubling over the past three years. Mobile games, which can be played easily at any age, are also popular. Since Japanese players tend to stick with one mobile game for a longer period than other players, the amount of money spent on mobile games is higher compared to the rest of the world.

🔶China:Mobile First Economy

Due to the strict regulations of the Chinese market and the fact that the major consoles are from foreign companies, the percentage of console players in China are almost negligible in stark contrast to Japan and Korea. After the near-total ban on video games was lifted in 2015, there have been some Chinese consoles introduced to the market, however they have had very limited success. In order for foreign companies to sell games on legitimate Chinese consoles, the games have to go through censorship, an extensive and time consuming process resulting in a large barrier to entry for foreign games. Due to this and the rapid development of e-money, smartphones have taken over the market and represent the vast majority of gamers in China.

🔶Korea:The Culture of Online PC Gaming

Korea, often considered an IT superpower, boasts a PC ownership rate of 69.6%, significantly ahead of other countries like America (50.0%) and Japan (24.4%). Korea has also had a thriving PC LAN Gaming Center culture, resulting in many opportunities for Koreans to come into contact with a PC from an early age. This combined with the fact that many of the games that are popular in Korea are also released on PC has led to a strong and thriving PC market. As with other regions, the market for mobile gaming is continuing to grow and mobile gaming has now snagged a majority of the market share.

Source:https://prtimes.jp/main/html/rd/p/000011111.000007006.html

Source:https://www.4gamer.net/games/999/G999905/20220725049/

Source:https://www.donga.com/news/Economy/article/all/20220309/112238232/1

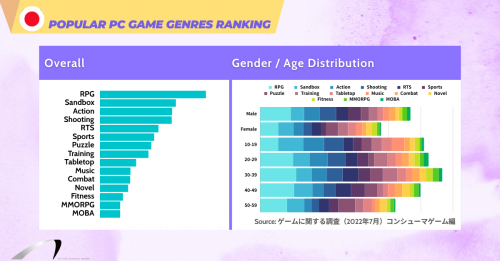

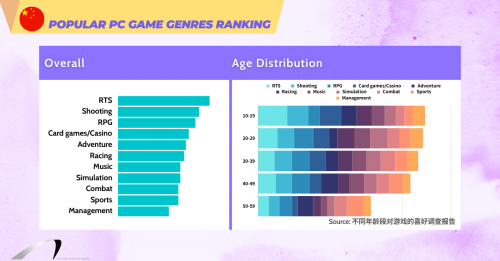

Analysis of Top Game Genres & Age Groups by Region Within Asia

Furthermore, national characters differ from one country to another due to cultural differences, so too as one can imagine do the preferred game genres. Therefore, in order to have an effective marketing strategy in the Asian game market, it is essential to consider individual strategies for each country instead of lumping them together under the broad category of “Asia”. In addition, as with other markets, there is significant blurring depending on the age. In other words, when selling games in the Japanese, Chinese, and Korean game markets, it is essential to develop personas based on data from each country. Using the following data, let’s analyze the age group that matches the game you want to sell, and whether it is a casual or core gamer group, taking into account the ratio of platforms.

Japan’s Game Market ※Excluding Mobile Games

RPG games rank first among Japan’s favorite genres, being so popular that their unique style and love of the genre created their own sub-genre(JRPG). However, among teens and 20-somethings, sandbox games slightly edge out RPGs with major titles such as “Minecraft” and “Animal Crossing” snagging a lionshare of the market. Shooting games are also popular among teens, with titles such as “Fortnite” and “Apex” among the most popular. For Japanese in their 30s and 40s, RTS games tend to be more popular compared to other generations with series like Fire Emblem and Super Robot Wars being a mainstay for gamers in Japan.

China’s Game Market

The number one favorite game genre in China is RTS. However, the Chinese gaming market is unique compared to other markets in that it does not vary much by age. This is due in part to the fact that the population is extremely trend-conscious, and due to the large number of mobile game users, the same title tends to create massive popularity booms among all generations. Therefore, the ranking of favorite genres can vary greatly from year to year depending on the latest trend. The most popular RTS game among all generations is “Honor of Kings,” which is overwhelmingly popular among all generations. In the Chinese ranking, MOBA games are also included in the RTS games, including “League of Legends,”. RPG games are more popular among those in their 10s and 20s than among other generations, with “Genshin Impact” and “Honkai: Star Rail” proving very popular among younger generations. Among shooting games, “PUBG” and “Crossfire” mobile games have long been favorites.

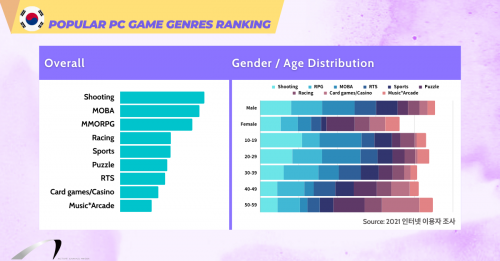

Korea’s Game Market※Excluding Mobile Games

Shooting games reign as the top game genre in South Korea. As in China, “PUBG” is popular among teens for both PC and mobile. However, among players in their 20s, non-battle royale style shooting games such as “Sudden Attack,” “Overwatch,” and “Valorant ” are popular. South Korea also boasts a larger percentage of female gamers in their player base compared to the rest of the world. Gaming is popular among adults in their 30s and 40s, with “FIFA ONLINE” being a major title. Similarly, RTS games are also popular among players in their 30s and 40s, with “HearthStone” being the leading title, while card games/casino games vary widely among players in their 50s, with the browser game “Hanafuda” being a strong favorite in Korea.

Game Communities & Viewing Platforms for Games & Main Advertising Sites

Additionally, even within the same region in Asia, there are differences in the use of social media, video platforms, and gaming communities. If you dive even deeper into each region, there are changes depending on whether you are a casual or hardcore gamer, as well as different breakdowns by age groups. In this chart, we have listed those in their teens, 20s, and 30s, which will generally cover the core population of each country. It is also important to choose the right social media that matches your game and target demographics, as well as where to place advertisements to increase their effectiveness. In Japan and Korea, Instagram is popular, but is generally recommended for mobile games and less so for other platforms. Tiktok in China is also a recommended advertising platform for mobile games. While TikTok’s popularity in Japan is high, the user base is very young, in their teens, and it is generally not popular among a lot of gamers. However, for casual gamers who enjoy free-to-play mobile games, it can be used as an effective marketing tool.

Why Gamers Make a Purchase & Marketing Pricing

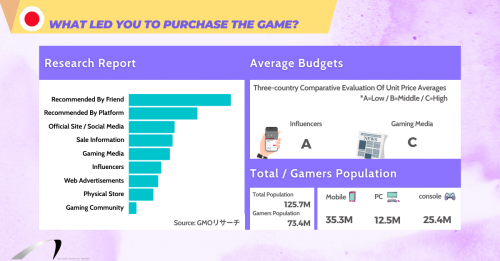

Finally, we will introduce the main marketing strategies in each region, the factors that lead to a purchase, and an evaluation of the average unit price within each of the regions. Each region has its own characteristics in marketing and by understanding these characteristics, an effective marketing strategy does not necessarily have to be an expensive marketing strategy. By selecting promotional strategies that are effective according to game genres, age groups, and so-called personas, it is possible to increase the effectiveness and scope of the promotion even when large budgets are not available. Also, influencers have their own speciality and community, so it is important to select the right influencer for both the game and marketing strategy. As is the case with any influencer, the bigger the influencer, the larger the variety of fans that tend to enjoy the content is. Therefore, it is important to keep in mind whether the goal is to raise awareness through impressions or build engagement within your game community when choosing an influencer.

Japan’s Game Market

In Japan, a significant percentage of purchases are the result of platform recommendations or sale information sources. This is in line with the typical national character of Japanese people who tend to consume items recommended by official sources or friends. The reliance on known and trusted sources can lead to high barriers when it comes to purchasing foreign games. Information is often packed into the more traditional forms such as books, magazines, movie posters, etc. This makes game media an indispensable part of any promotion strategy in the Japanese market with the results often out performing influencers. As a result, when compared to their western counterparts, the average unit cost for paid media tends to be higher, while the average cost for influencers tends to be relatively low.

China’s Game Market

In China, you find a robust mobile user population alongside a significant number of PC users. What really separates China from other Asian countries though, is the rise of short-form video applications (e.g., TikTok, Douyin). These platforms allow users to quickly gather information in an easy to understand and enjoyable way, allowing them to stay on top of the most current trends. This naturally leads to influencers having a strong sway on consumers, especially when it comes to the younger generation who have grown up in recent years relying on these apps for their entertainment. On the other hand, the core gamer group still gathers information through gaming media, as well. When it comes to the average cost, China does fall in line with Japan and Korea. However, the frequency of press releases tends to be quite low compared to them. It is recommended that you seek advice from a professional marketing agency.

Korea’s Game Market

The marketing competition in Korea tends to be quite intense, with companies placing great importance on aggressive marketing and advertising to attract consumers’ attention. With this in mind, budgets tend to be a bit more expensive than compared to China or Japan. Another unique aspect of the Korea market is that the online communities tend to be very well developed with users belonging to communities based on their preferences. Korea has a strong tendency for players to only focus on a single genre of game. By understanding this and focusing your marketing efforts on the communities that match your game, you can get a very high engagement rate even if the overall impression rate is low.

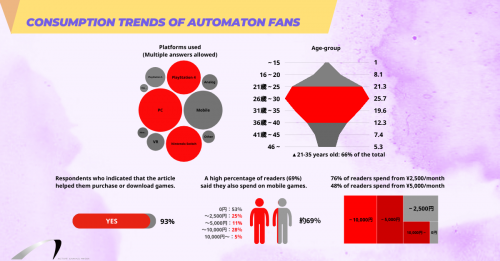

Our Game Media: AUTOMATON

We operate one of the largest gaming media in Japan and are committed to providing valuable information and creating articles based on information not often handled by other media or based on different points of view to provide the best unbiased news source for gamers. Because of our commitment, we have more users who read our articles more carefully than other media. Core gamers along with people involved in the gaming industry in Japan rely on the authenticity of our website to keep them up to date with the latest news. With an average monthly PV of 10 million and consistently high impressions, we are able to promote our products with high engagement. Please contact us for additional information.

Our Game Promotion Service Results

Kenshi

Region:Korea, China

Languages:Korean, Chinese

Services Provided in Korea:

- Game Localization

- Steam Page Store Localization

- Press Release Distribution

- Influencer Outreach(Youtube, Twitch)

↳ Low cost, high return

Services Provided in China:

- Game Localization

- Steam Page Store Localization

- Press Release Distribution

- Social Media Management(Weibo)

- Influencer Outreach(bilibili, Douyin)

↳ Gained 4k followers in one week

Our Multilingual Community Management Service

The Caligula Effect 2

Region:English-speaking countries, Japan, Korea, Taiwan

Languages: English, Japanese, Korean, Chinese

Services provided in English:

- Translation of updates and post-launch announcements (Steam, X(Twitter))

- Translation of bug reports in native language in a timely manner

- Translation of user requests in a timely manner

- Translation and posting of promotional announcements (Steam, X(Twitter))

↳ Services provided led to a significant reduction in negative comments – 161 positive to 12 negative

Services provided in Japanese:

- Translation of updates and post-launch announcements (Steam, X(Twitter))

- Translation of bug reports in native language in a timely manner

- Translation of user requests in a timely manner

- Translation and posting of promotional announcements (Steam, X(Twitter))

↳ Services provided led to a significant reduction in negative comments – 19 positive to 1 negative

Services provided in Korean:

- Translation of updates and post-launch announcements (Steam, X(Twitter))

- Translation of bug reports in native language in a timely manner

- Translation of user requests in a timely manner

- Translation and posting of promotional announcements (Steam, X(Twitter))

↳ Services provided led to a significant reduction in negative comments – 17 positive to 3 negative

Services provided in Taiwan:

- Translation of updates and post-launch announcements (Steam, X(Twitter))

Translation of bug reports in native language in a timely manner

Translation of user requests in a timely manner

Translation and posting of promotional announcements (Steam, X(Twitter))

↳ Services provided led to a significant reduction in negative comments – 18 positive to 1 negative

Feel free to contact us with any questions about marketing in Asia or any other questions you may have!

As mentioned earlier, we offer marketing services throughout Asia. Please feel free to contact us with any questions regarding marketing in Asia or any other topics related to marketing and gaming. We often work with a variety of companies, from small indie developers to AAA companies, from publishers to gaming products. We can offer marketing solutions suited to each region to match your budget and product. Please feel free to contact us to explore potential solutions to your needs.